Are telcos destined to be pipes?

Are telcos destined to be pipes?

The TMT industry has reinvented itself multiple times over the past decade. The rate of change is expected to accelerate, forcing Telcos into a constant stage of disruption or transformation across the technology, cloud, and infrastructure layers. Beyond the constant change, the dominance of hyperscalers and OTT players combined with the emerge of InfraCos are cornering Telcos into competing on connectivity. A space that will become ever more challenging given the pace of fixed and mobile technology evolution.

Our perspective examines the need for telcos to go back to the basics of infrastructure leadership, growth, and simplification to reset their equity stories. We also explore emerging strategic archetypes for telcos globally. Success in the exciting but tumultuous time ahead will require multi-faceted market-specific strategies that considers the scope of Telco businesses, assets, capabilities, and corporate structures.

The more things change, the more they stay the same

The TMT industry has reinvented itself multiple times over the past decade. Network operators have had to evolve their businesses from voice-driven, country-specific oligopolies to multifaceted companies that need to compete with globally scaled OTT players across a multitude of digital services including communications, content, and FinTech. Far from being finished, this disruption is expected to accelerate across the technology, cloud, and infrastructure layers.

Tech: Fully empowered digital consumers and the rapid E2E digitalisation of businesses are accelerating the shift to a Metaverse (& web 3.0) centric world with ever more digital-physical fusion. Major digital platforms and hyperscalers, recognising the opportunity, are investing in innovation at global scale (20x times more than telcos), with the aim of becoming ubiquitous across industries and creating new verticals. Widespread adoption of artificial intelligence, robotics and automation across industries is finally starting, due to boundless applications and efficiency gains.

Cloud: The public cloud market has increased ~3x over the last 5 years; however, a significant shift is underway from the original hyperscale computing and storage services. Growing demand for real-time interactions, compliance with restrictive local data laws, and increased cybersecurity will in turn drive demand for computing power and storage much closer to the end customer or at the edge. This will ultimately require deep network-cloud convergence where hyperscalers serve as the global wide area network (replacing backbones), powering operator core networks & interconnecting at the edge.

Infrastructure: At the digital infrastructure level, ultrafast (1+ Gbps) broadband will become ubiquitous, delivered by advanced fixed (fibre) & wireless technologies (5G+, LEO satellites, etc.). Enabling high-bandwidth and low latency services will become the driver for connectivity growth. The combination of regulators viewing connectivity as a basic human right, competitive pressure, and increased demand for the next high-latency services will force network operators to fully explore new shared business models that are more cost-effective.

This market transformation will again force telcos to adapt and reinvent their businesses. As before, this will not be an easy journey.

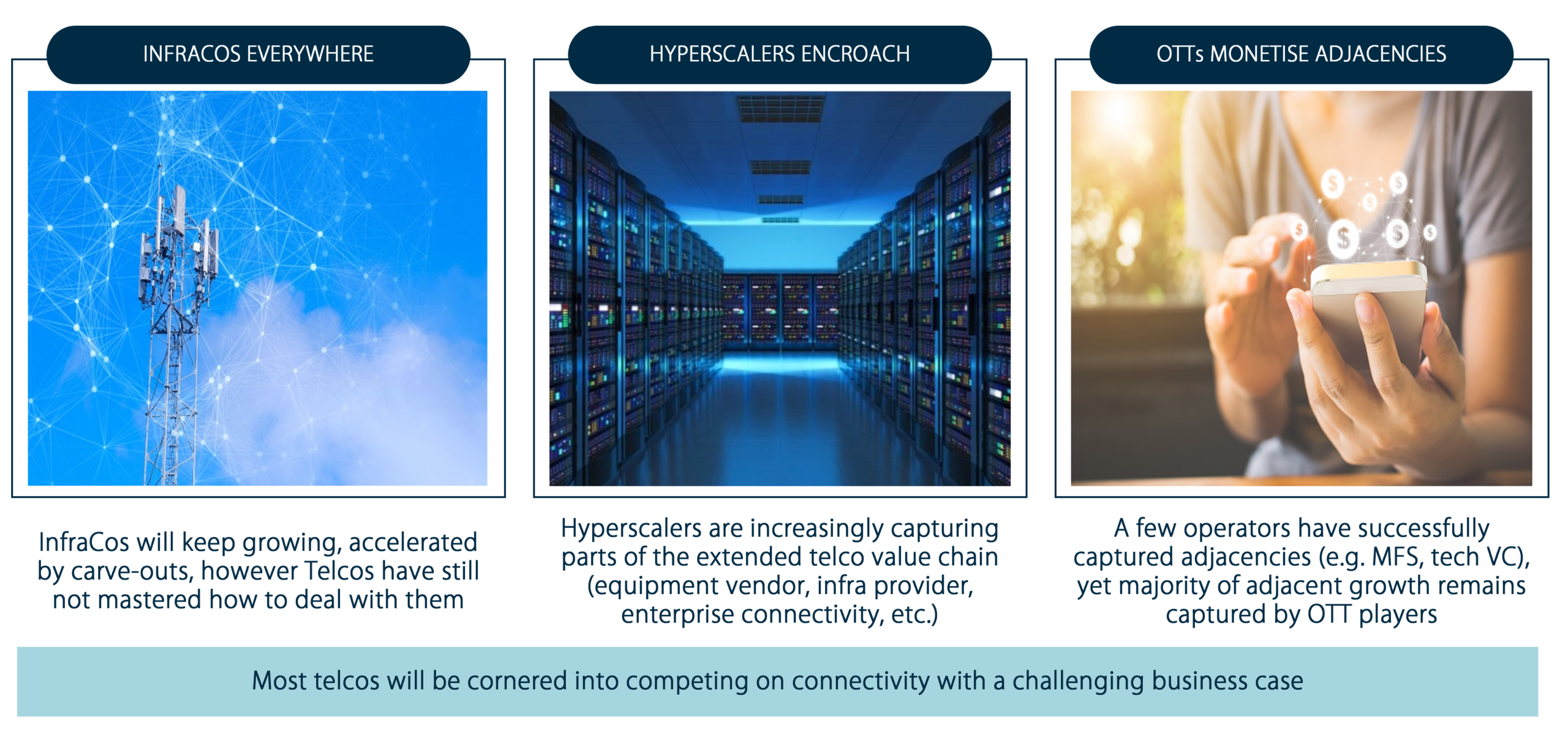

Market transformation cornering telcos into competing on connectivity

Listed infrastructure revenues have grown 77% over the last 5 years while listed telcos have not even managed to grow 17%. Telcos have embraced the InfraCo model by carving out infrastructure, with deals increasing ~5x over the last 5 years. However, telcos have not managed to operationally master InfraCos – even their own carve-outs. InfraCos have captured the lion’s share of value from infrastructure with EBITDA increasing by 86% over the last five years (vs 15% for telcos). If this continues, operators will struggle to reach a harmony where they economically deploy new technologies (5G and edge computing).

Hyperscalers are increasingly capturing parts of the extended telco value chain through selling equipment (cloud-based) and providing infrastructure, or more tellingly, directly foraying into enterprise connectivity, e.g., Amazon Private 5G. Will this lead to hyperscalers capturing most of the gains expected from digitisation, AI, and automation, as InfraCos did with infrastructure?

Adjacent verticals are expected to grow from $1b today to $5b in 2030. However, only a few operators have successfully captured adjacencies. MTN and Safaricom are good examples, where mobile financial services constitute between a third and half of overall services revenues. Most of the adjacent growth over the last decade was captured by over the top (OTT) players. This was despite significant effort from Telcos. Media and content are great examples: multiple operators ventured into this space, e.g., ATT + Warner, Verizon + Yahoo, and Telefonica, but this for the most part destroyed massive amounts of value. The key to success appears to be being in the right market with the right conditions, where telco traditional strengths enabled them to succeed. Will recent TechCo bets pay off? It’s still too early to say, but the gap in capabilities and limited R&D spend raises question marks at the very least.

In a world where InfraCos and hyperscalers extract most of the value out of the infrastructure layer and OTTs / digital platforms continue to capture adjacencies, telcos will be increasingly forced to compete on connectivity.

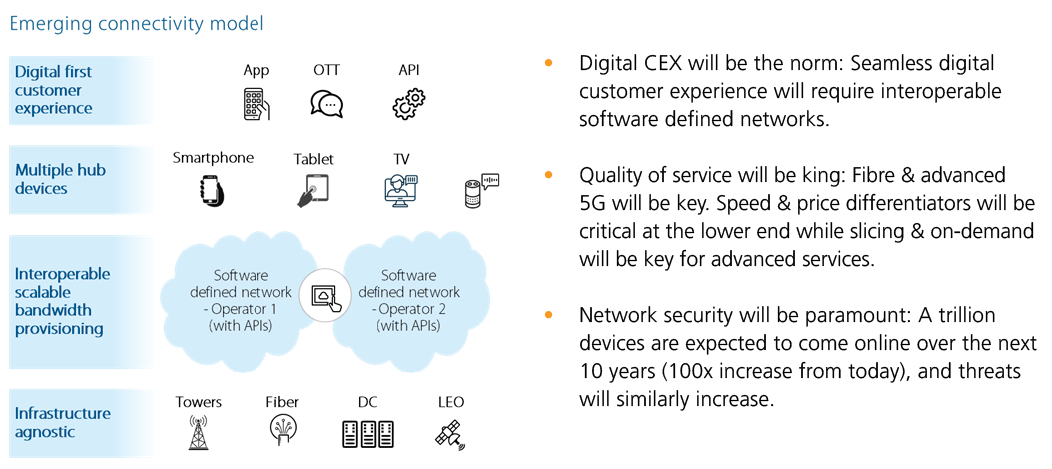

Competing on connectivity will become more challenging

Consumer-driven data growth enabled telcos to offset declining voice revenues and drive single digit overall growth over the last 10 years. Growth in the next 10 years will be driven by B2B and application-based connectivity. B2B and application-based connectivity will require a reboot along three key dimensions:

Telcos will need to virtualise networks E2E, migrate core IT systems to cloud-first architectures, deeply-interconnect with competitors and infrastructure providers, and recruit tech talent to effectively compete on the next generation of connectivity.

Operators need to reset the equity story

In the face of adversity, operators need to reset their equity story as being perfectly positioned to capture growth from the market transformation while driving scale and efficiencies. To make the equity story credible, it should be underpinned by a clear strategy, built on three pillars.

Infrastructure leadership: Unbundle network to provide a geo-specific QoS to address different segments while making the tech stack flexible; market consolidation given the right conditions.

Growth: Rethink how to go-to-market (e.g., new B2B / B2B2C and wholesale models) and develop platforms & partnerships (e.g., tech partnerships, investments).

Simplify and optimise: Develop new ways of working, build capabilities, and attract new talent while offloading non-core assets, e.g., poor performing digital assets or OpCos.

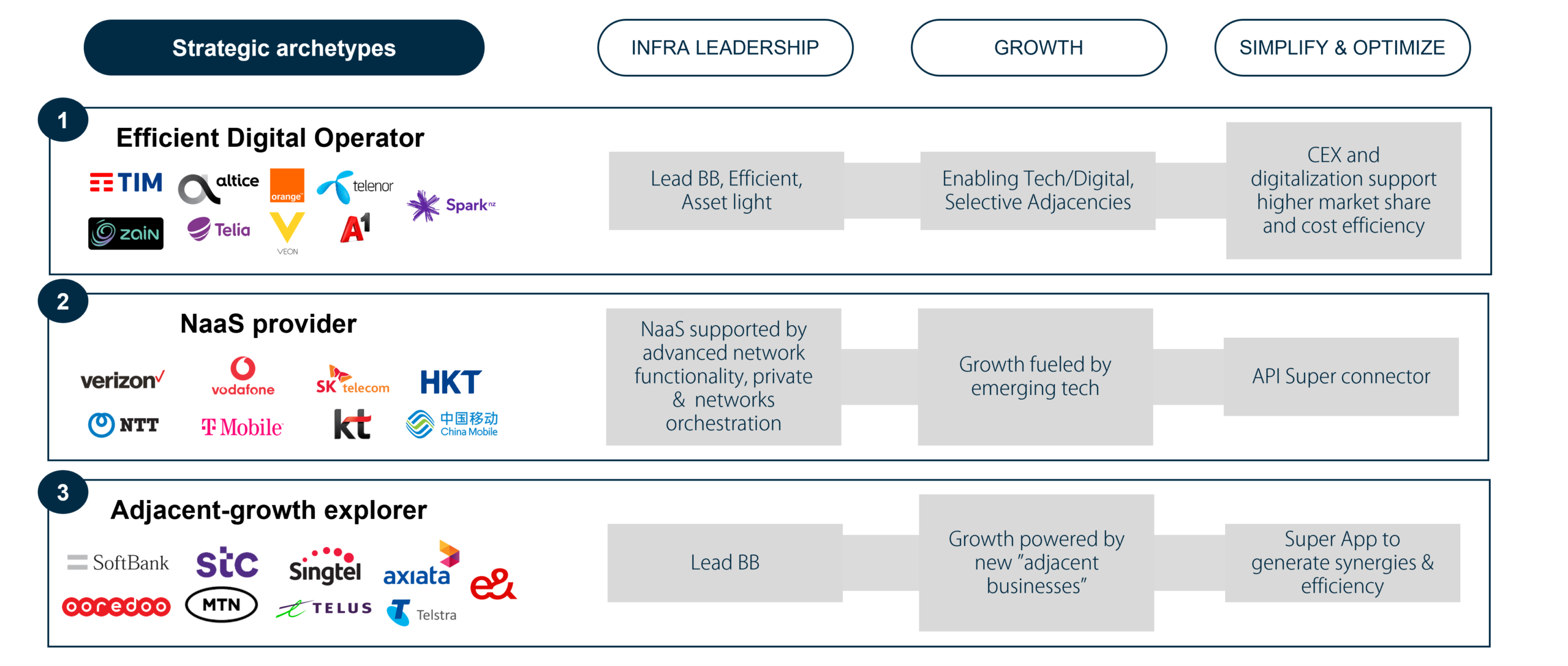

Globally, three non-exclusive archetypes emerge across telco strategies. All three archetypes will be present in well-defined strategy; however, one archetype is typically pre-eminent. The three strategic archetypes will have a different focus on infrastructure leadership, growth, and simplification / optimisation.

The efficient digital operator

Efficiency enabled by digitisation, AI and automation will be a key focus for all telcos. However, some will make it their mission. The efficient digital operator will have a strong focus on a truly digital customer experience while pursuing major opportunities (e.g., FWA, connecting new digital verticals) while ruthlessly driving digitisation and cost efficiency across their operations and networks. The ultimate goal is to lead the broadband market on price differentiation and experience. This archetype will have a conservative investment profile characterised by the monetization of existing assets and infrastructure sharing in order to return cash to shareholders. Key risks for this archetype revolve around sustaining market position while returning cash to shareholders.

Network-as-a-service provider

Adjacent verticals are expected to grow by more than $3 trillion by 2030, and network-as-a-service (NaaS) operators will look to capitalise. Advanced connectivity (i.e., 5G and fibre) will be critical for the technology-led service innovation underlying the growth in adjacencies. NaaS operators will seek to generate medium term growth by monetising the advanced network capabilities required for new services (e.g., emerging tech, smart cities). This archetype will aim to achieve network advantage from both a functionality and cost perspective to drive market leadership. Key sub-segment bets for NaaS operators include 5G stand-alone networks, mmWave deployments, private networks, and industry-specific emerging tech solutions. The archetype will be concentrated in developed markets with advanced connectivity and tech industries. Key risks for NaaS operators will revolve around the take-up of emerging technologies and ability to orchestrate / establish new ecosystems and partnerships.

Adjacent-growth explorer

Another approach to capitalising on the expected growth in adjacent verticals, is by creating new “adjacent” businesses, e.g., ICT, Fintech, infrastructure (data centres). Adjacent-growth explorers will directly participate in niches where they have a strong right to win. A strong right to win in any adjacent business will be highly market specific. The objective is to achieve sustainable FCF growth by building new businesses across the footprint before ultimately monetizing with an IPO. This archetype will be more common in the developing world and markets with legislation favourable to incumbents. This strategy will require a very aggressive investment profile with patient shareholders. Key risks for adjacent-business operators resolve around the ability / capabilities to develop and operate new businesses, first at home and then internationally.

Conclusion

The changing market brings uncertainty, but also presents a plethora of opportunities for telcos that are able to play a key role in enabling the technology-led transformation. Opportunities range from direct participation in adjacencies or emerging verticals, such as immersive experiences, to being enablers or orchestrators of newly developing ecosystems, such as smart cities. However, telcos will need to evolve their business and operating models to overcome a succession of challenges to traditional business lines. While some opportunities and challenges are global, many will require a market-specific approach. Telcos will need to go back to the basics: infrastructure leadership, growth, and simplification. They need a market-specific strategy that considers the scope of their businesses, assets, capabilities, and corporate structures to successfully navigate the tumultuous but exciting times ahead.

Finally, telcos should learn from the past and avoid previous pitfalls:

Price race to the bottom: 5G will create new economics & pricing opportunities. Operators should not drastically drop prices to chase market share but rather price in a value accreditive manner for the industry

Underinvest in network quality and differentiation: Quality of service will be critical to be successful in the new network landscape. A poor network experience will always be a key driver of churn

Stray too far from the core business: Investments very far away from an operator’s core service, connectivity, have in the past been very difficult to monetise and will continue to be so in the future

Limit growth with infrastructure sharing or carve-out deals: Ability to differentiate network in selected geo-areas will be critical, thus sharing deals should pivot to rural areas and localized networks, e.g., indoor small-cell, while carve-outs need to be executed in a manner that does increase the costs to deploy new technologies