Beyond the picket line: SAG-AFTRA strike’s unintended benefits to the industry

Beyond the picket line: SAG-AFTRA strike’s unintended benefits to the industry

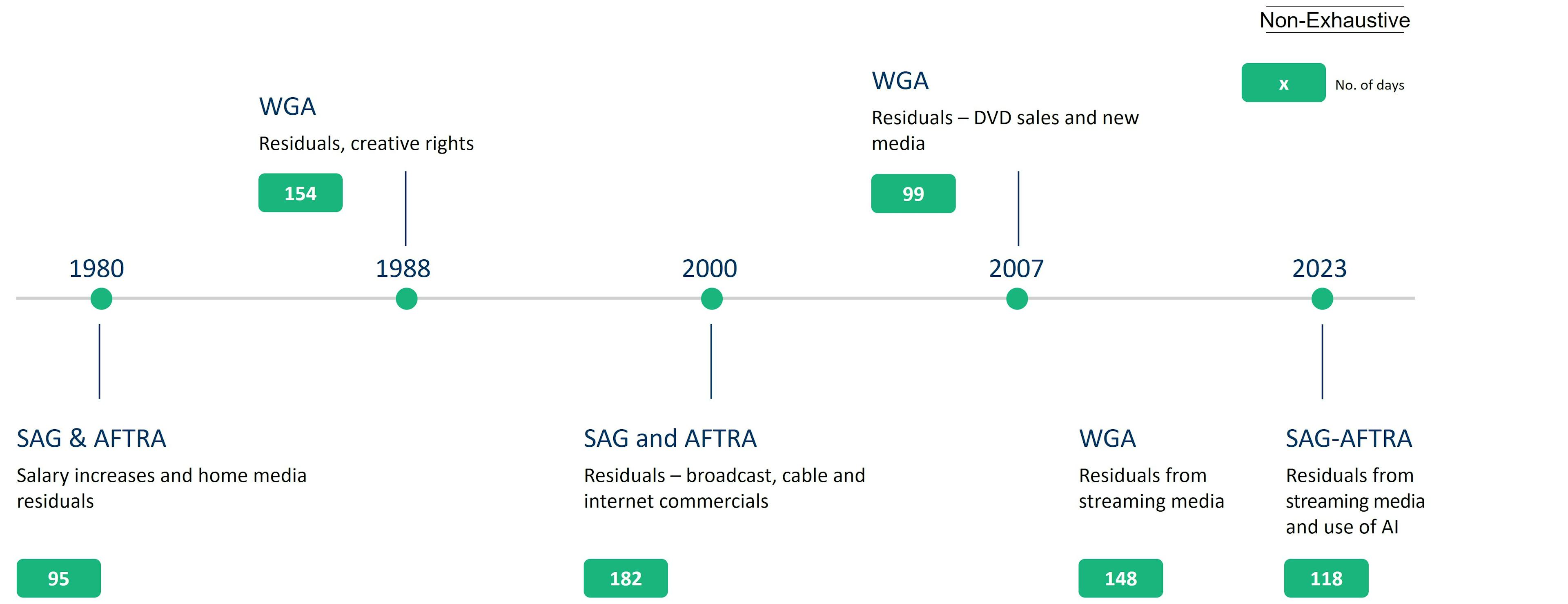

The year 2023 has seen hundreds of strikes and labor demands from thousands of workers in multiple industries in the United States. Hollywood was no exception, with a dual strike by its screenwriters and actors that brought production to a halt for over 100 days. This was not the longest strike in the history of Hollywood; previous strikes in 1988 by the Writers Guild of America (WGA) and SAG (Screen Actors Guild) and AFTRA (American Federation of Television and Radio Artists) in early 2000 lasted 154 and 182 days, respectively. However, it was different from previous strikes in that demands were not limited to compensation or profit-sharing but also raised existential questions about the future of the industry due to the impact of artificial intelligence.

The SAG-AFTRA strike was officially considered over when its members voted to ratify their contract on December 5, following a suspension of the strike on November 8. The contract, which is valid for three years, secured a 7% increase in rates in its first year and $40 million as a participation bonus for actors on popular streaming shows. However, as evolving technologies are increasingly impacting the industry, the deal also protects actors by requiring their consent to the use of their features in Generative AI production tools(1).

While it was taking place, the strike was estimated to have cost the U.S. economy $6-$7 billion(2); resolution became crucial, given the long-term impact the strike was bound to inflict on the industry in terms of production spending and volumes, and on the different players in the value chain (especially businesses that enable production through the services they provide, such as catering, filming equipment, props, etc.).

HOLLYWOOD STRIKES, 1980-2023

(Duration and main demands)

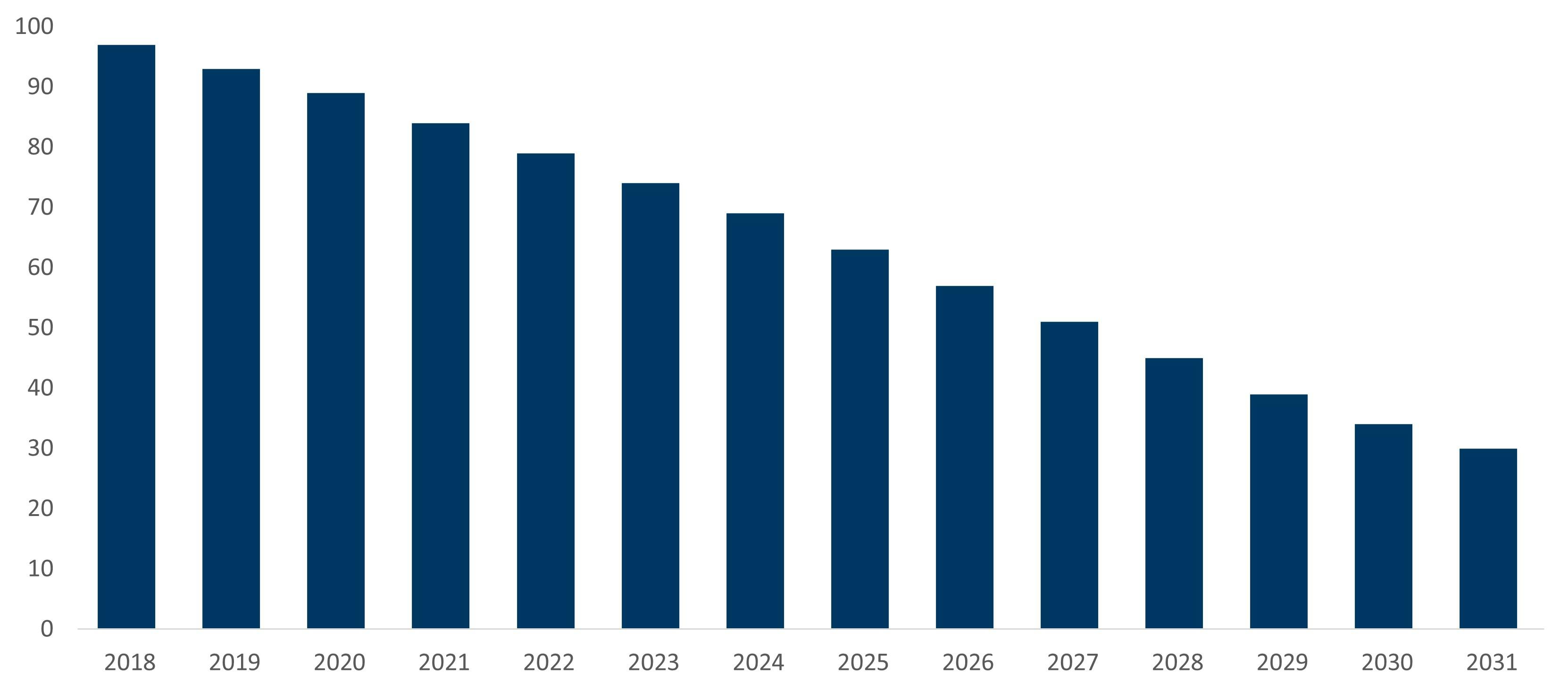

The strike’s unintended consequences – and unintended “winners”

The shift from traditional exhibitions (movie theaters, television) to “streamers” started over 10 years ago and accelerated during COVID-19. The strikes likely further accelerated this trend, as traditional TV is the segment most affected by production halts, due to its strict programming schedules. Some streamers could also shift some of their content budgets toward their growing network of international content producers who were unimpacted by the strikes. According to FTI Delta’s forecasts, the number of traditional multichannel households is expected to continue to decline between 2024 and 2031, with the acceleration mainly driven by some sports rights moving to streamers or D2C providers and the potential shutdown of small cable networks.

TOTAL U.S. MULTICHANNEL VIDEO PROGRAMMING DISTRIBUTOR (“MVPD”) SUBSCRIBERS

(Millions)

Note: MVPD subscribers include residential and commercial Traditional MVPD and vMVPD subscribers.

Traditional MVPD includes cable, DBS and telco subscribers.

The strikes also helped resolve an urgent problem for major media companies: making streaming profitable. Prior to the strikes, streamers (old and new) were locked in a cycle of destructive competition, investing heavily in original content to win subscribers. Complications arose when subscriber growth slowed and the cost of capital increased, motivating a flurry of cost-cutting initiatives and incipient production cuts before the strikes, coinciding with a variety of well-publicized revenue tactics (e.g., price increases, a crackdown on password-sharing). Amid this, the strikes offered an ideal way for the entire industry to reset spending and production volumes downward, a de facto collusion among competitors. The streamers had only to promote their deep libraries of previously produced titles. According to Moody’s Investors Service, the actors’ and writers’ strikes granted the studios a cash flow benefit

of over $10 billion(3).

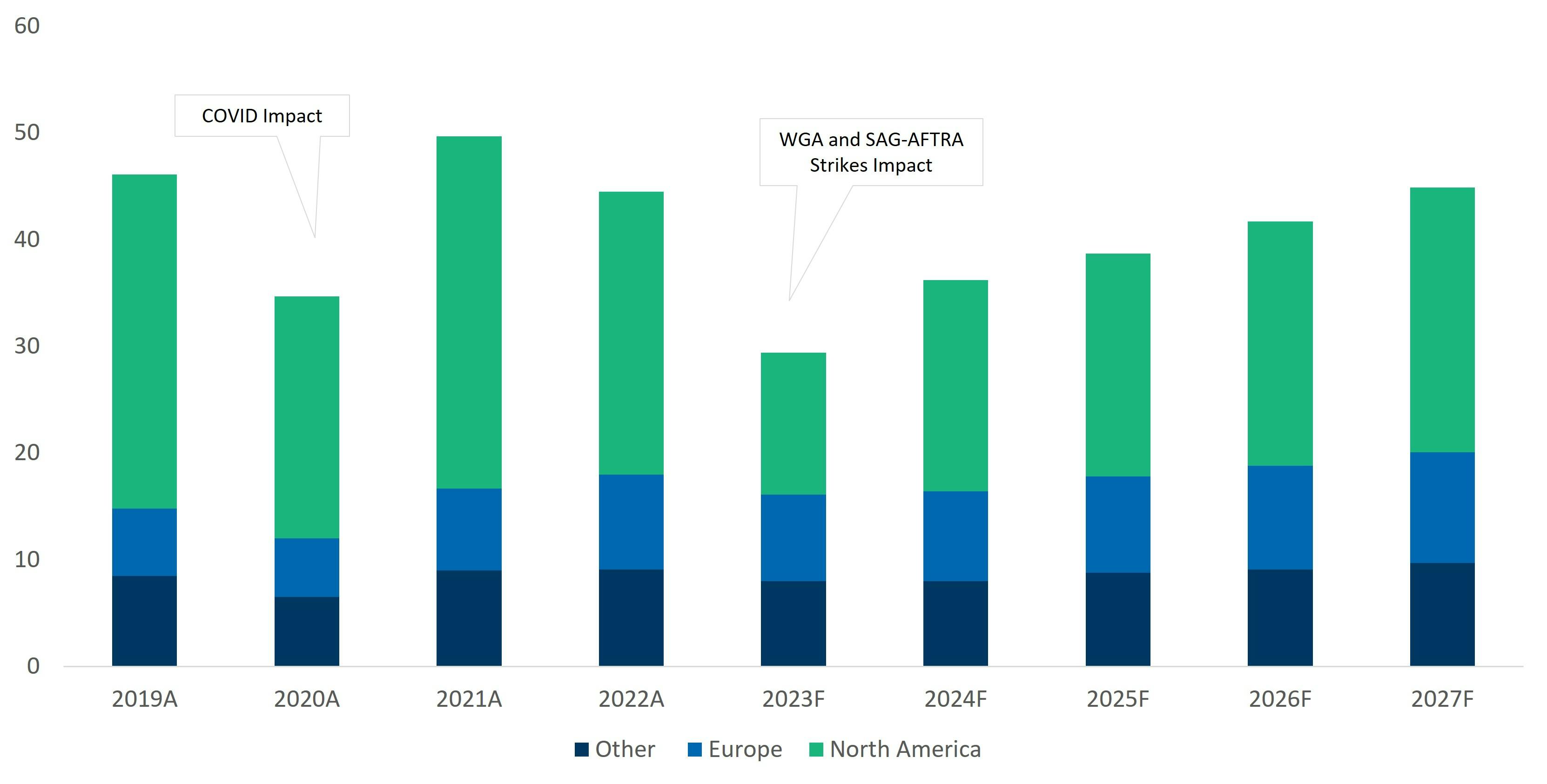

Impact on future production spending

So how far did spending fall? Focusing on the global market for premium English-language production spend, we see decreases in 2022 and, of course, in 2023, resulting in a 2023 level roughly 40% below the peak spending year of 2021. The U.S. market is expected to see a rebound in 2024 of approximately 25%; however, the peak production levels seen in 2021-22 are not expected to return during the forecast period as streamers focus on profitability and sustainable growth. Meanwhile, spending from broadcast (-12% CAGR from 2019 to 2026) and basic cable (-21% CAGR from 2019 to

2026) is expected to see meaningful declines as cord-cutting accelerates and declining viewership weighs down advertising revenue. When it comes to regional differences, North America is set to rebound significantly in 2024 but lose relative production share in the coming years to Europe and the UK, as well as other countries around the world.

The combination of a strong dollar and now a higher cost structure due to the new WGA and SAG-AFTRA deals has eroded the relative competitiveness of U.S. (and some Canadian) production at a time when production know-how and quality continue to grow outside of North America.

GLOBAL ENGLISH LANGUAGE TOTAL PRODUCTION SPEND BY REGION (2019–2027F)

(Millions)

Sources: FTI Delta research and analysis, Variety Insights, SNL Kagan, Deadline, Rodriques Law PLLC, Irish Film Services, Forbes, British Film Commission, Variety, Entertainment Partners, Mestiere Cinema, official government websites of Georgia (U.S.), California, the EU and Canada.

Sources of international competitiveness include:

—Recent examples of success: Success stories of international productions with North American

audiences are now numerous (e.g., Heist, Narcos, Squid Game) and have inspired an incremental shift

in the budget toward non-English content dubbed and subtitled into different languages.

— Cost to produce: International productions are typically cheaper to produce than the domestic U.S.

productions (often half the cost or less), which helps increasingly cost-conscious streamers.

— Talent quality: International talent quality has improved in recent years and is significantly

cheaper than U.S. talent.

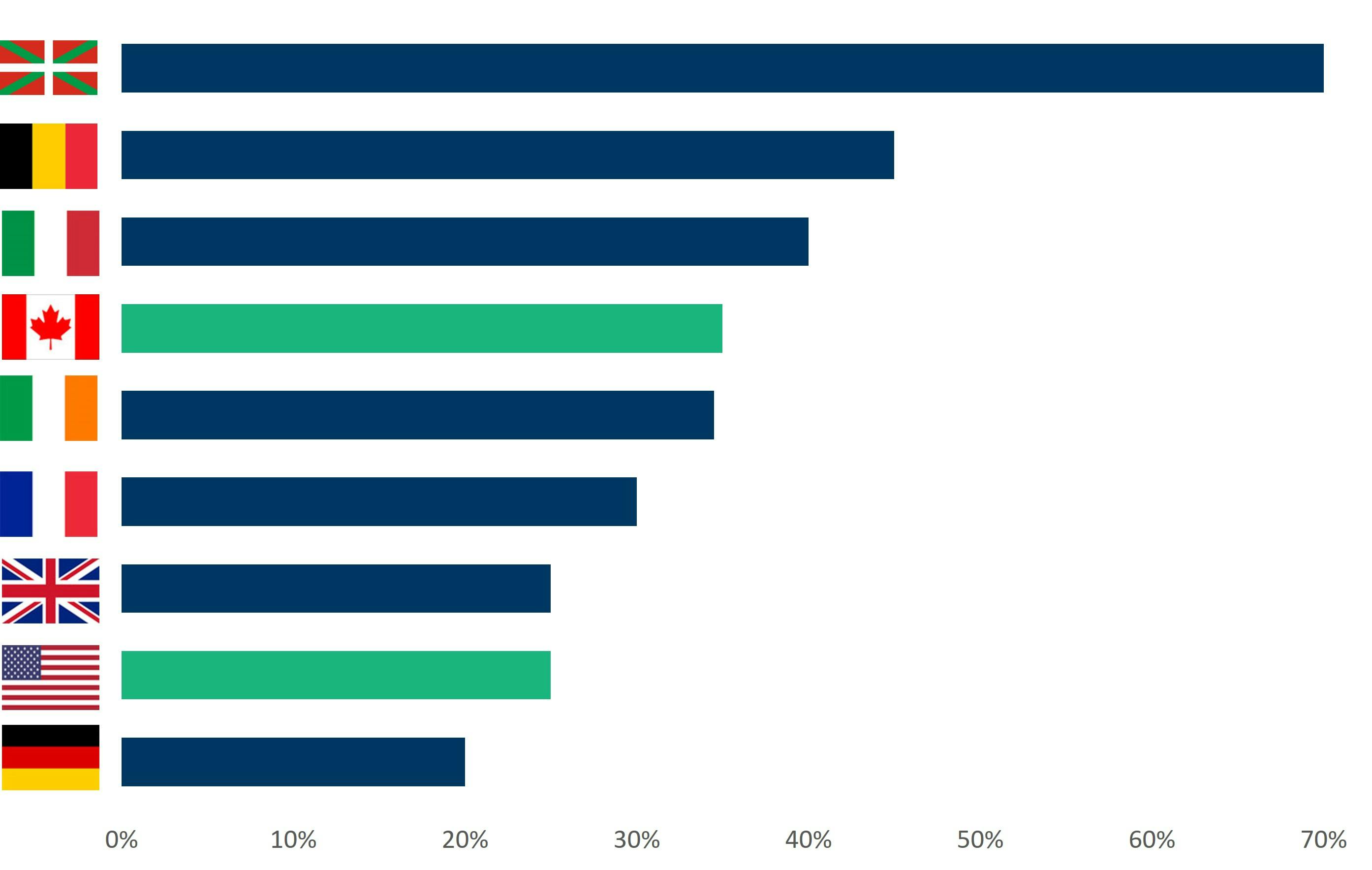

— Incentives: Many countries, including most of Europe, offer increasingly strong production incentives in addition to an appealing variety of on-location options.

TAX CREDITS/INCENTIVES. EUROPE VS. NORTH AMERICA

(%)

As the industry continues to observe shifts in consumer viewing habits and tastes, the latest strike has created an opportunity for streamers and content creators to reassess content strategies. Despite the turbulence of recent years, this is expected to result in a more sustainable and healthier growth environment going forward and may also lead to structural market changes such as additional consolidation.

The views expressed in this article are those of the author(s) and not necessarily the views of FTI Consulting, its management, its subsidiaries, its affiliates, or its other professionals.

Footnotes

(1) https://variety.com/2023/biz/news/sag-aftra-ratifies-contract-1235822165/

(2) https://www.linkedin.com/pulse/hollywood-strikes-specter-artificial-intelligence-kevin-klowden-7mjxc/

(3) https://www.mediapost.com/publications/article/391016/actors-deal-estimated-to-cost-studios-450m-600