2024 Media & Entertainment Predictions

2024 Media & Entertainment Predictions

In 2024, the media and entertainment industry continues broadly to grapple with the contraction of the once highly profitable linear TV and print sectors amid the growth of less-profitable digital and direct-to-consumer businesses.

1. Live entertainment rebounds post-pandemic, with emerging sports leading the surge and offering investment potential in production and infrastructure

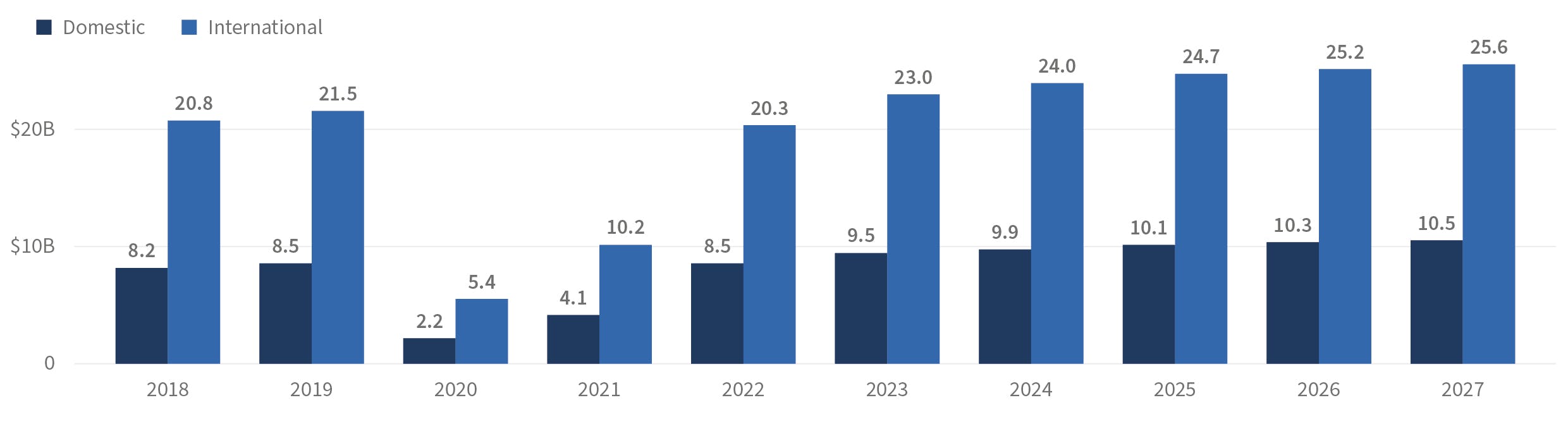

In the wake of the global pandemic, the entertainment industry faced many challenges. However, recent data paint a promising picture of recovery and growth, particularly in live events. Consumers in 2022 and 2023 returned to concerts in droves, with worldwide spending on live music in 2023, up 49% compared to 2019. Equally noteworthy is the resurgence of major sports leagues, including the NFL, NBA, MLS, NHL and IndyCar, whose attendance figures not only recovered but surpassed pre-pandemic levels. This resurgence signals a robust return to the communal and immersive experiences that define live entertainment.

The growth trajectory of live entertainment post-pandemic is not uniform, as forecasted trends point towards particular strength in emerging sports such as racing, soccer and youth events. These sectors are experiencing a notable surge in popularity, hinting at a dynamic evolution in audience preferences. From adrenaline-packed racing events to the fervor of youth sports, the diversity in live entertainment offerings reflects a broader spectrum of interests, thereby amplifying the overall appeal of the industry.

Global & u.s. live music ticket sale forecast

Billions

This resurgence in live entertainment not only spells good news for fans but may also present opportunities for investors. Production services for live events (including the provision of production crews, equipment, on-screen talent, signal transmission and various related media supply-chain services) may offer several investment opportunities in the years ahead. Larger “Tier 1” global providers may seek further consolidation to gain further economies of scale and higher asset utilization. Mid- and smaller-sized “Tier 2+” providers may have an opportunity to consolidate around bespoke solutions for specific events, sports, and/or customer segments (e.g., college athletics). Additional investment areas include infrastructure services (i.e., temporary infrastructure for events), exhibition rights, and investments in sports teams and leagues. Chief among diligence questions should be how sustainable certain post-COVID growth drivers will be in the years ahead, including the recent surge in VIP and ultra-VIP upselling. As the industry evolves and consumers continue to appear hungry for real-world experiences, investors may find opportunities to benefit from the next leg of growth.

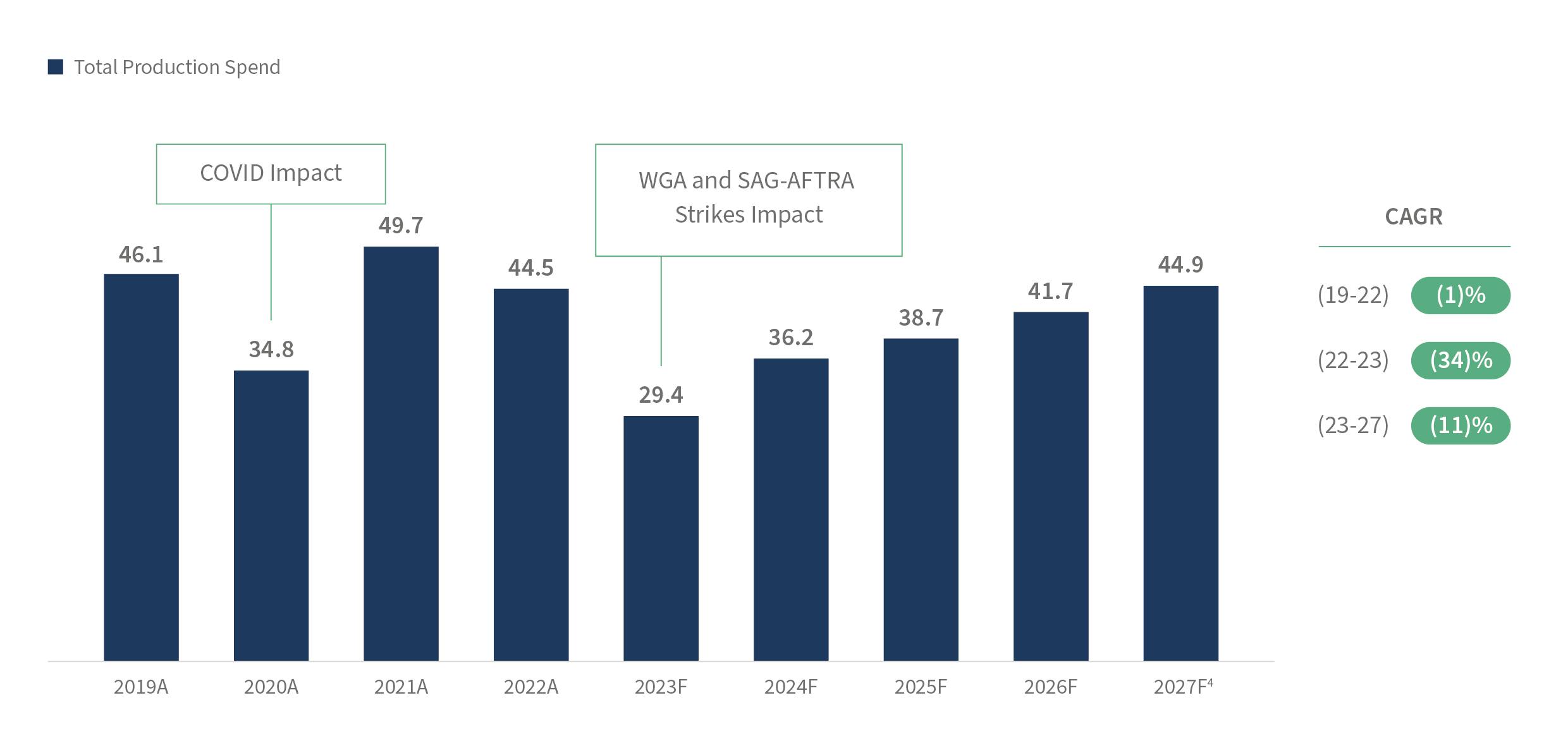

2. The filmed entertainment industry navigates post-strike challenges, with subdued recovery and potential consolidation pressures across the supply chain

The filmed entertainment industry faced unprecedented challenges in the latter half of 2023 as the Writers Guild of America (WGA) and the Screen Actors Guild–American Federation of Television and Radio Artists (SAG-AFTRA) strikes exacerbated the struggles of an already sluggish market. The impact of labor disputes, coupled with a staggering 70%+ decline in production and marketing expenditures during 3Q23-4Q23, cast further gloom over an industry that was already grappling in early 2023 with tightening studio budgets, and 2023 spending ended down approximately 35% from 2022 (full year).

While the market recovered sharply at approximately 45% YoY in 2021 following COVID, the 2024 recovery post-strike is expected to be more muted, at approximately 25% YoY, in light of streamers reprioritizing profitability amid flattening subscriber growth. The United States will see the sharpest post-strike recovery, as domestic productions were most directly affected by the strike while European productions saw smaller impacts. Some amount of the geographic share shift created by the Hollywood shutdowns is forecast to endure over the coming years because territories like Europe benefit from a strong dollar, lower labor costs and robust government incentives. They have also been closing the gap in quality.

Global English Language Total Production Spend by CONTENT TYPE (2019–2027F) (1-3)

Billions

Source: FTI Industry Research

Otherwise healthy companies serving the filmed entertainment sector now find themselves under stress and often carrying greater debt. Many production suppliers invested in additional capital and labor during the boom years of 2021–2022 (sometimes at high prices), only to carry the additional cost structure into the 2023 shutdowns. The prospect of consolidation across the supply chain now looms. This period of volatility could ultimately lead to a reshaping of the industry, with stronger entities absorbing weaker ones. For stakeholders, adapting to these changes becomes imperative to not only survive the immediate challenges but also to position themselves favorably in the evolving dynamics of the filmed entertainment sector.

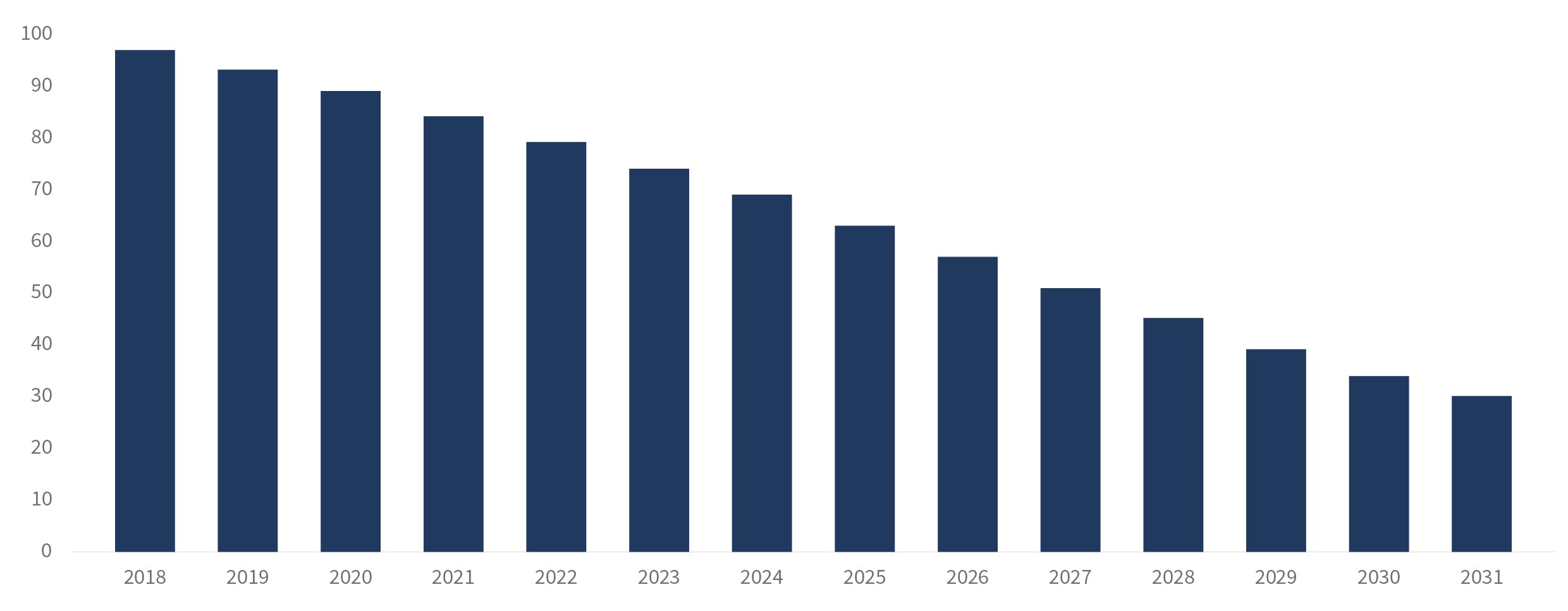

3. Streaming transforms media consumption as MVPDs lose subscribers, prompting a shift towards profitability and ad-supported tiers

Over the period from 2018 to 2030, multichannel video programming distributors (MVPDs ) are projected to lose a staggering 63 million subscribers, reflecting a negative 8.3% compound annual growth rate (CAGR). This accelerating decline puts immense pressure on companies heavily reliant on the traditional cable bundle, prompting strategic discussions to begin making more radical changes to adapt to the evolving preferences of audiences and the demands of shareholders. Since Disney and Charter reached renewal terms in late 2023, which included Charter dropping several tier-2 Disney linear networks along with Charter subscribers gaining access to the ad-supported-tiers of Disney subscription video on demand (SVOD), we expect significantly more pressure on linear network providers to rationalize their large portfolios of duplicative cable networks.

Amid the continued migration of viewers from traditional linear to streaming offerings, the streaming industry is witnessing a crucial focus on near-term profitability, driven by investor pressure. DTC operators and distributors are engaging in talks about the potential introduction of new bundles incorporating both linear and digital services or multiple digital entertainment services, seeking innovative ways to retain and attract viewers.

Total US MVPD subscribers

Millions

Note: MVPD subscribers includes residential and commercial Traditional MVPD and vMVPD subscribers. Traditional MVPD includes Cable, DBS, and Telco subscribers.

This year will be the first with multiple, scaled, ad-supported streaming tiers of premium video content. With the launch of ads in Amazon Prime Video in January 2024, Amazon will immediately join Hulu as the only two premium ad-supported SVODs with truly scaled audiences (e.g. , 75M+ viewers). With Disney+ and Netflix continuing to rapidly grow their ad-supported tiers and Peacock hosting the 2024 Summer Olympic games, the number of scaled premium ad-supported SVODs will continue to increase. For streamers looking to continuing growing and improving profitability, advertising will be the primary focus for increasing the top line.

This shift not only underscores the urgency to address the waning appeal of legacy cable offerings but also highlights the industry’s renewed commitment to adapt to the dynamics of the digital age. As companies grapple with these challenges, opportunities for restructuring and redefining content distribution models emerge. For investors who can purchase declining linear assets at the right price, a cash-flow-oriented harvest can deliver excellent returns.

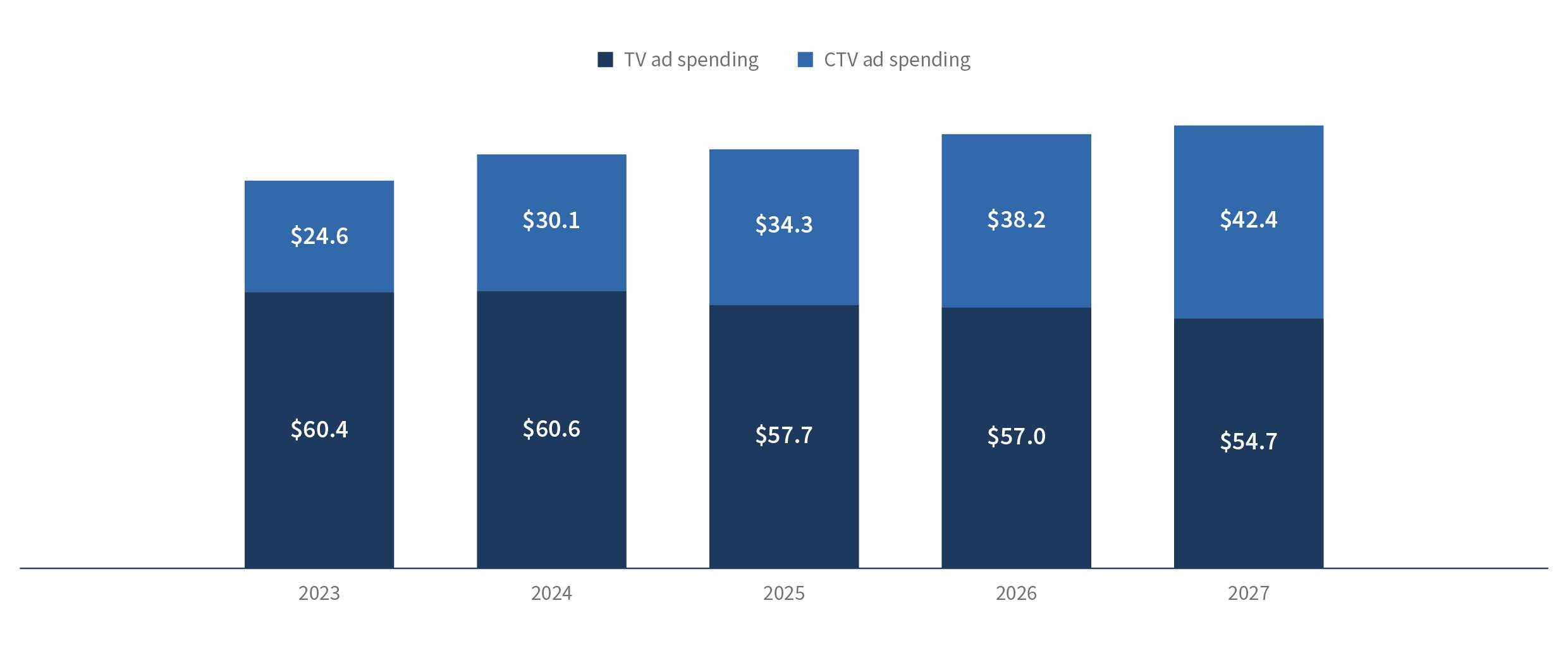

4. CTV ad spending rises, fueled by premium streaming and shoppable TV, reshaping advertising and sparking investment in ad tech

Combined U.S. TV and connected TV ad spending is forecast to continue growing through 2027, when it will reach nearly $100 billion; however, all of this growth will be driven by CTV, which is expected to be one of the two fastest-growing advertising sectors in 2024, increasing by $5.5 billion or 22% YoY.

This rapid CTV advertising growth is driven by premium ad-supported streaming. By 1Q24, every major streamer (except Apple) will have launched ad-supported SVOD tiers, leading to mass audience adoption. Led by Hulu and Amazon Prime Video, with Peacock (and the 2024 Summer Olympics), Disney+ and Netflix rapidly gaining ad-supported audiences, multiple premium streamers are now surpassing the audience scale of traditional linear networks. With the presence of truly scaled audiences on CTV and the promise of executing efficient and effective whole funnel marketing campaigns, advertisers are now following en masse. The forecast growth suggests that CTV advertising is becoming an integral part of the media mix, offering a blend of reach, targeting and measurability .

U.S. tv and connected TV (CTV) ad spending, 2023-2027

Billions

One of the most promising advertising innovations that CTV offers is “shoppable TV.” And nowhere is that more apparent than with Amazon Prime Video with Ads. With the launch of the ad-supported tier in January 2024, Amazon immediately was able to offer advertisers a scaled CTV audience of over 70 million viewers. To effectively target that scaled audience, Amazon leverages not just their first-party viewership data but matches that to the richest set of first-party shopping data from its ecommerce platform. Because Amazon has its own streaming platform and ecommerce platform (not to mention Alexa devices), it can present the most seamless user experience for shoppable TV ads, from viewing the ad to transacting the product.

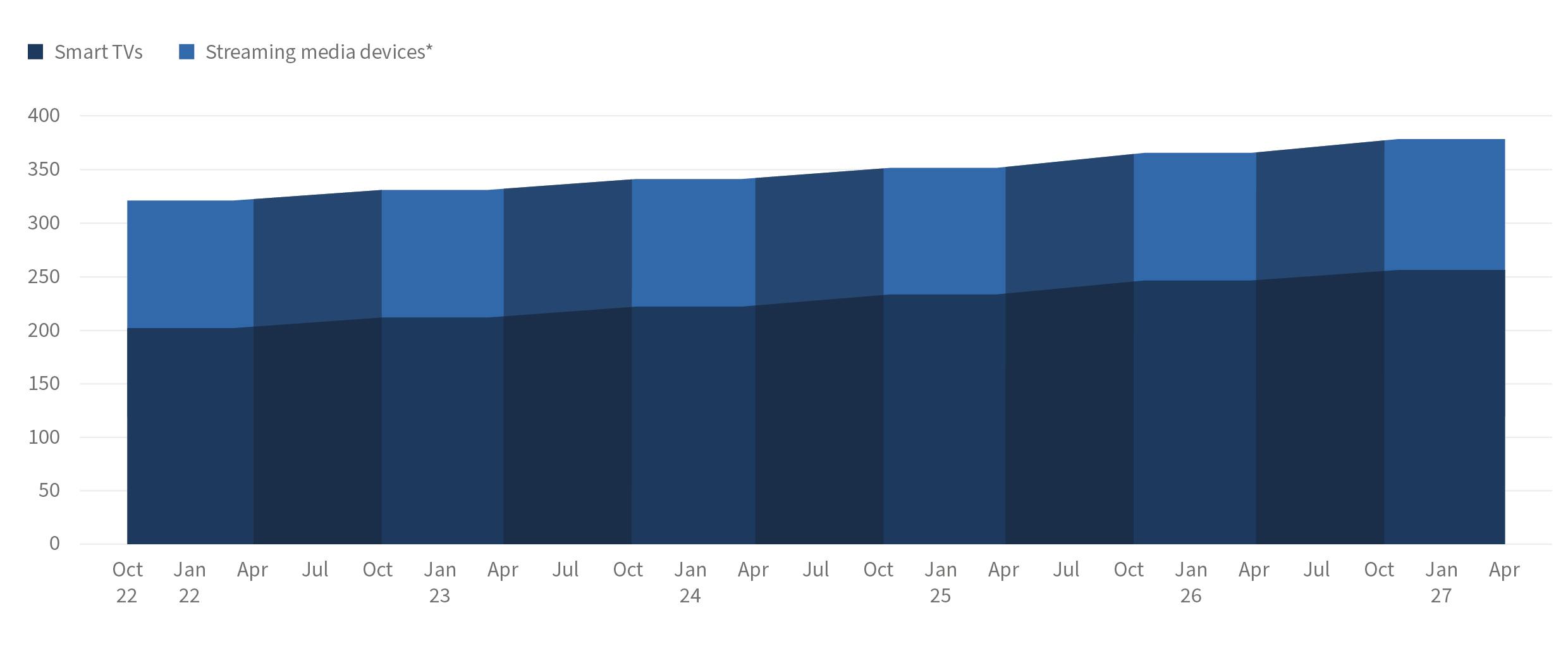

U.S. connected TV device installed base

In millions

Note: *Streaming media devices includes hardware with the primary function of streaming IP video to a television set or other display, including sticks (e.g. , Fire TV stick) or boxes (e.g., Apple TV); Excludes smart speakers or other devices that stream video as an ancillary function; Excludes hardware actively managed by a broadband or multichannel operator.

Even at this nascent stage, there is sizable consumer appetite for more targeted, shoppable advertising on connected TVs. Per a recent LG Ad Solutions report, seven in 10 viewers like TV ad creative that includes a QR code. And over 50% of viewers wish they could shop online directly through their TV. This shoppable TV opportunity is the best focus area for premium video platforms to capture and retain ad dollars that may otherwise migrate to social platforms.

As advertising becomes the primary focus for premium streamers’ top-line revenue growth, private equity firms may find investment opportunities in the ad tech, infrastructure and service businesses that support this growth. Select targets within these sectors could emerge as attractive propositions for private equity, aligning with the evolving needs of advertisers seeking innovative solutions in the dynamic CTV landscape.

5. The surge of retail media suggests that it is on a trajectory to reshape the advertising landscape

As of 2023, forecasts suggested that retail media was set to experience year-on-year growth of 19.7%, making it the second-fastest-growing ad format, trailing only behind connected TV at 21.2%. However, 2024 forecasts for retail media of 22.5% growth suggest an acceleration that now places retail media as the leader in growth, ahead of CTV. As these numbers suggest, retail media is on a trajectory to reshape the advertising landscape.

At these rates, retail media ad spending is poised to surpass linear TV by 2025 and would nearly double by 2027, with retail media networks (RMN) reaching $106.1 billion compared to linear TV’s $56.8 billion. This remarkable surge underscores the value advertisers see in targeting their message to consumers directly at the point of purchase, a tactic that is transforming the advertising landscape as it reaches scale.

Despite the meteoric rise of RMNs, the trend also brings forth challenges such as measurement and third-party verification. The absence of standardized metrics both within retail media networks and in comparison to other media channels remains a particular concern. Despite challenges, the evolution of retail media is driving ad innovation, and the integration of dynamic creative (automation) may drive incremental value and sector growth. As the industry races to embrace this new advertising channel, stakeholders will need to proactively address advertiser concerns to ensure the sustained success of RMNs.

6. The video game industry adapts amidst rising costs, investor shifts, and esports resets, focusing on blockbuster IPs and tech innovation

In recent years, the video game industry has been on a rollercoaster ride marked by a remarkable 9.2% CAGR from 2019 to 2022, despite experiencing a 6.3% dip from the peak of the 2021 COVID-induced surge. Console sales in 2022 remain 18% higher than in pre-pandemic 2019 according to Ampere analysis; however, the mobile sector, an important growth engine over the past decade, faced significant challenges. The removal of identifier for advertisers (IDFA) in iOS by Apple has led to a staggering 70% increase in user acquisition costs, creating headwinds for mobile gaming.

While the mid-term outlook for the overall video game market remains positive with above mid-single-digit growth to 2025, the higher cost of the capital environment has shifted investors’ focus towards profitability and cash flow generation, resulting in a range of cost and labor reductions throughout 2023 and into 2024. Additionally, the record-high gaming valuations of 2022 have eased, possibly opening the door to some targeted value opportunities.

The esports space is also facing a reset after a significant bull run, with a range of esports participants (incl. Teams and events organizers) experiencing challenges. The esports market is still expected to grow rapidly (14% CAGR between 2021 and 2026 according to PwC), though it remains nascent.

Across video games and esports, selective consolidation is expected to continue, as well as cost-savings and turnaround endeavors. Challenges in customer acquisition and the maturity of mobile (esp. casino and social) and PC/console will likely prompt a shift towards “blockbusterization” with a renewed focus on leading intellectual property (IP)-focused assets. Technological shifts including AI (which may impact productivity and streamline tasks), and a continued shift to free-to-play and live ops are expected to contribute to the ongoing transformation of the section. The industry, at a crossroads, invites players to navigate the terrain with strategic foresight while delivering near-term tactical improvements.

7. Social media’s influence persists as user growth slows, driving a surge in ad spend and propelling the rise of influencer-led entrepreneurship

Social media continues to be a driving force, even as user growth in the United States experiences a gradual slowdown, with a CAGR of 1.8% projected from 2022 to 2025. Despite this, the pervasive use of social networks remains high, and advertisers are capitalizing on this trend, with ad spend forecast to surge at a more robust CAGR of 7.5% during the same period.

While most social media inventory is controlled by Meta and Alphabet, influencer marketing remains a more open ecosystem. Marketing spend directed toward “influencers” (popular social media personalities who endorse products) and “creators” (independent content creators) is experiencing a remarkable surge, boasting a CAGR of 14.3% from 2022 to 2025. What’s intriguing is the parallel emergence of influencers and creators venturing into entrepreneurship by launching their own consumer packaged goods (CPG) brands. This dual phenomenon suggests a transformative phase in which influencers are not just endorsers but also active participants in the product creation process.

In light of these trends, select social media services such as influencer marketing and their related platforms and infrastructure are poised for expansion. The prospect of creating more systematic platforms to support the growth of creator-launched CPG brands might offer additional investment opportunities. When evaluating influencer marketing, investors should focus on assessing (a) the scalability of the target’s system or platform, (b) dependency on retaining and monetizing top “star” talent, and (c) vulnerability to changes in social media algorithms or other platform tech. In a sector otherwise dominated by big tech, with limited opportunity for private capital, influencer marketing remains a bright spot.

8. Publishers adapt to ad slowdowns, culture wars, and trust crises by diversifying into podcasts and games

Digital publishers find themselves grappling with a substantial slowdown in digital advertising growth, a trend projected to persist with a 1.0% CAGR between 2021 and 2026 as programmatic CPMs headwinds combine with the rollout of cookie deprecation on Google’s Chrome. This decline is exacerbated as audiences increasingly migrate to social media platforms, leaving publishers contending not only with financial challenges but also with navigating the intricacies of culture wars and a crisis of trust among journalists. Social media platforms continue to deprioritize news and other third-party publisher content in favor of user-generated content and vertical video, which further emphasizes publishers’ need to build a direct and loyal audience.

In response to these challenges, major publishing brands such as The New York Times and The Wall Street Journal are strategically broadening their offerings. Diversification into podcasts and games serves as a means to retain both subscribers and advertising dollars, acknowledging the shifting preferences of an audience accustomed to multimedia consumption.

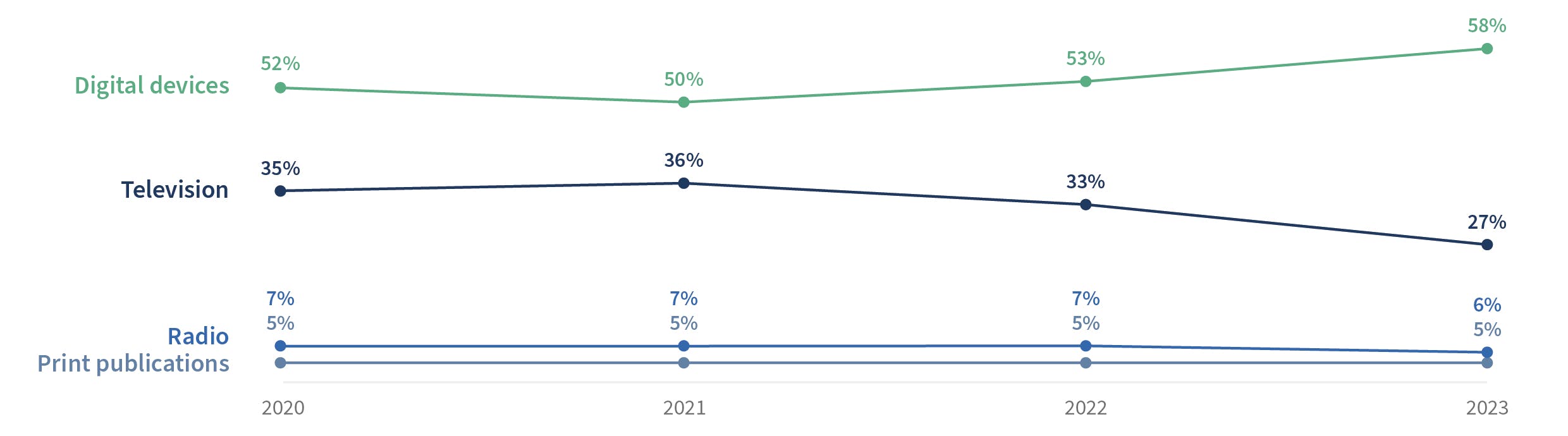

New platform preferences

% of U.S. adults who prefer _____ for getting news

The stark financial realities reveal a stark choice for publishers: continue to struggle with the diminishing returns of legacy monetization models, or embrace transformation of both the revenue and cost structures. The numbers paint a compelling picture, urging a strategic shift.

Facing the challenge of slowed growth in digital subscriptions and a decreasing ad inventory value compared to social networks and connected TV, publishers should consider how to maximize the profitability of the current model while exploring new revenue streams. Audiences desire news and publishing content, and the business model must adapt to meet their expectations. An opportunity arises to shape the future of media by strategically combining the strengths of digital natives with the rich heritage of traditional media. This fusion has the potential to create a powerful and relevant source of information that resonates with diverse audiences while ensuring financial sustainability. In essence, the key lies in a balanced approach that capitalizes on digital opportunities without completely abandoning the foundations of traditional media.

Subscribe to Access Our Latest Insights

Meet Our Experts

Phil SchumanSenior Managing Director, Media & Entertainment Sector Leader

Phil SchumanSenior Managing Director, Media & Entertainment Sector Leader Francesco Di IanniSenior Managing Director

Francesco Di IanniSenior Managing Director Daniel PuntSenior Managing Director

Daniel PuntSenior Managing Director Garazi GoiaSenior Managing Director

Garazi GoiaSenior Managing Director Justin EisenbandSenior Managing Director

Justin EisenbandSenior Managing Director Antonio GuastafierroSenior Managing Director

Antonio GuastafierroSenior Managing Director Sebastian BlumSenior Managing Director

Sebastian BlumSenior Managing Director