2024 Telecom Predictions

2024 Telecom Predictions

The global telecommunications sector is undergoing a transformative journey into 2024, shaped by strategic imperatives, dynamic trends and new opportunities for innovation and resilience.

1. Separation and delayering of assets becomes an integral part of the industry’s evolution

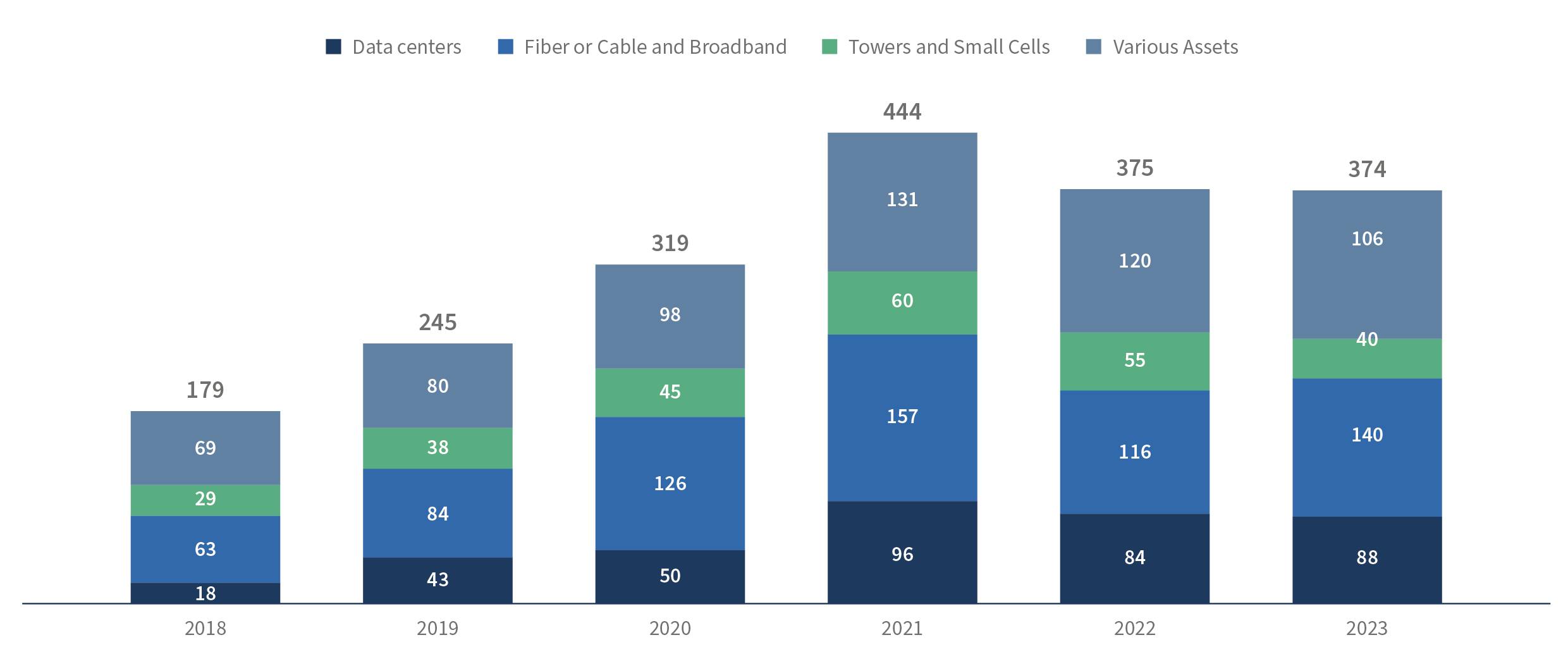

The telecommunications industry is undergoing a significant shift driven by the imperative need for cost optimization and operational efficiency, and the rising cost of capital. The relentless pursuit of improved performance has given rise to the trend of asset separation and delayering. Telecommunication companies are compelled to reevaluate their operational structures and focus on carving out both passive and active network infrastructure assets into distinct entities.

This trend is marked by a meticulous emphasis on the separation of crucial assets, with a special spotlight on fiber and data center infrastructure. Telecom operators are exploring innovative models such as NetCo versus ServeCo to streamline their operations and maximize efficiency. This delayering process involves a thoughtful separation of network components, leading to a more agile and cost-effective operational framework. As a consequence, telecom companies are not only able to enhance their operational efficiency but also optimize their capital investments.

Investors are actively engaging with and demonstrating a keen interest in these carved-out infrastructure assets. The financial appeal of this trend is substantiated by an increased influx of capital into these separated entities, with carved-out entities often attracting higher valuation multiples compared to integrated entities. For instance, in 2015, after the separation of Inwit, a spin-off of tower assets from Telecom Italia, the combined market cap of Inwit and Telecom Italia was ~40% higher than that of Telecom Italia pre-separation. Similarly, the separation in 2015 of Telefonica O2 in the Czech Republic into CETIN, the infrastructure unit with ownership of fiber and tower assets, and O2, the retail arm, is an important reference point. Per industry reports, in five years, the combined market capital of the separated entities became more than 2x. Moreover, in 2020, after the separation of Vantage Towers from Vodafone, the combined market cap of Vodafone and Vantage Towers was ~50% higher than that of Vodafone pre-separation.

GLOBAL number OF digital infrastructure DEALS

This trend has been observed in the Asia Pacific region as well. For example, Telstra has carved out its infrastructure assets into InfraCo and Amplitel (towers), while telcos in Indonesia such as XL Axiata and Indosat Ooredoo Hutchison (IOH) have separated their data center assets and monetized them in 2019 (XL Axiata) and 2022 and 2023 (Indosat). Another recent example’s Singtel’s establishment of Digital InfraCo as a separate infrastructure subsidiary in 2023.

Recent market reports indicate a notable uptick in investor interest, with a growing number of telecom companies successfully attracting external funding for their standalone infrastructure assets. This financial backing underscores the viability and attractiveness of the separation-delayering trend.

Currently, Proximus in Belgium is planning to carve out its data centers to fund its 5G and fiber rollout ambitions. Moreover, Nabiax in Spain is expected to go through a similar process later this year.

In the Gulf Cooperation Council region, particularly in Saudi Arabia (KSA), there is a government-driven approach aimed at creating national initiatives in infrastructure development, such as the establishment of tower companies (Towercos).

The telecom industry is poised for a continued embrace of separation and delayering as an integral part of its evolution. The momentum gained from this trend is expected to persist as companies strive to strike a delicate balance between efficient operations and capital optimization. The NetCo vs. ServeCo models will likely see further experimentation and refinement as telecom operators seek the most effective and sustainable path forward in this era of rapid technological advancement.

2. AI, Automation and ESG set the telecom sector on a path for growth and cost efficiency

In 2024, the telco industry’s paramount focus is on pursuing increased efficiency through the integration of cutting-edge technologies like automation, including robotic process automation (“RPA”) and artificial intelligence (“AI”). This drive towards efficiency enhancement will lead telecom operators to redouble their efforts to transform into AI/automation-driven organizations by streamlining processes, reducing operational complexity, achieving cost savings and allocating human resources more strategically.

A further aspect is a concerted effort to enhance energy efficiency within the industry to reduce costs and align with the broader environmental, social and governance (“ESG”) agenda. This is achieved through decommissioning outdated, resource-intensive technologies such as 2G and 3G, transitioning away from copper-based infrastructure and implementing AI-based solutions to optimize energy consumption through the smart use (on/off) of different network elements.

Recent studies suggest telecom operators achieve up to 40% labor productivity gains and 30% labor cost reduction through the wide adoption of AI and automation. Our firsthand experience reveals a more modest, yet still highly relevant, 15%-17% labor cost reduction through decision-making optimization and streamlined workflows.

MAXIMIZING EFFICIENCY – USE CASES OF AI IN TELECOMMUNICATIONS

Furthermore, the transition away from legacy technologies has led to a considerable reduction in energy consumption. As an example, switching from copper cables to fiber optics can lead to energy consumption reductions of up to 80%, and 5G combined with AI features on traffic management can reduce by more than 90% the energy required on bits per kilowatt basis compared to previous wireless technologies. (Of course, this does not take into account the increase in number of bits being transmitted.)

The wide and deep adoption of AI in telecommunications appears set to continue and evolve. The ongoing integration of automation and AI is expected to mature, bringing forth even more sophisticated solutions that will redefine operational paradigms. The industry’s commitment to sustainability, as reflected in the push towards ESG goals and energy-efficient practices, is poised to become an enduring hallmark.

3. Fixed mobile convergence offers seamless integration to enhance customer relationships, reduce costs, and drive innovation

Fixed mobile convergence (FMC), the seamless integration of fixed and mobile services by one provider, is proving to be a pivotal strategy for telecom operators in highly competitive and increasingly saturated markets. Amid economic uncertainties, the specter of inflation, and slowing customer and revenue growth, telecommunication operators are strategically embracing FMC to maximize the value of their established customer relationships, streamline their operating costs, and drive product and service innovation. Customers benefit, as FMC provides them with a seamless and integrated communication experience, a one-stop shop to buy and upgrade services, a single service and support platform, and a single billing statement, all at a lower cost than the sum of the individual services when purchased separately.

Initially, operators implement FMC to grow their subscriber and revenue market share by cross-selling incremental wireless services to their wireline customers at a discount and vice versa. Such has been the case in the United States, where, during the last 12 months, cable players implementing FMC offers have concentrated over 40% of the wireless market net adds.

Furthermore, converged customers typically have lower subscriber acquisition and retention costs and substantially lower churn rates than non-converged customers (40%-70% lower), offsetting the cross-product discounts and thus resulting in higher customer lifetime value. Not surprisingly, FMC has also proven to drive net promoter score improvements of +20 points.

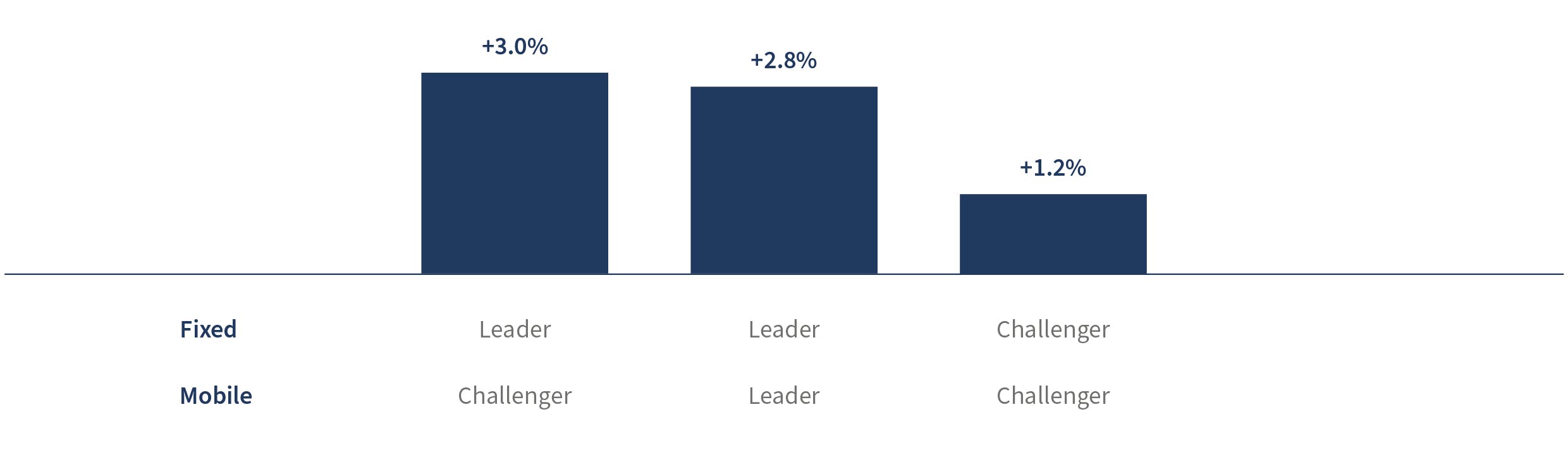

FMC revenue impact (real case studies)

% change on combined revenue three years after FMC launch

However, operators with established wireless and wireline services face the risk of repricing for customers who are already subscribed to their wireline and wireless services and might now benefit from the newly introduced FMC cross-product discounts. Proactively managing this repricing risk is critical to the overall success of FMC strategies.

After the initial cross-product discount phase, FMC strategies typically evolve to address the other FMC customer benefits, unlocking sales and service operational efficiencies and service innovation. In this case, the challenge is transforming operations to fully capture these efficiencies while providing a flawless customer experience. Such is the case across Europe, where FMC is more advanced than in the United States. Most FMC carriers are beyond cross-product discounts and are already bundling fixed and wireless into comprehensive packages with integrated billing and customer service. The FMC trend is unstoppable; others follow suit once a competitor embraces it. Pure fixed-only and mobile-only operators often need to reconsider their long-term strategic market position to compete against converged players and avoid a competitive disadvantage.

As operators continue to evolve their FMC offerings, go to market, and service and support operations, convergence will play a pivotal role in shaping the future of the telecommunications industry, offering operators a resilient foundation to better navigate economic uncertainties and further protect their revenue while reducing their cost to serve.

4. Fiber penetration continues to reshape industry infrastructure and create opportunities for savings and efficiency

The relentless march of fiber penetration continues to reshape the industry’s infrastructure. Across key markets in the United States, Europe, the Middle East and the Asia-Pacific region, the increase in fiber penetration continues unabated. We expect 2024 to be no exception, with increases in penetration levels of 4-6 percentage points in many markets.

Despite this unstoppable trend, nuances will start to appear across different geographies, given the disparity in overall penetration levels and changed financing market conditions. In Europe, for instance, substantial progress has been achieved, with fiber networks accounting for ca. 84% of homes passed. Given the increased cost of capital, we expect a shift from the sheer number of homes passed to a more nuanced approach that emphasizes both homes passed and homes connected. In addition, we also expect incumbents to look for opportunities to realize efficiencies, accelerating the switch-off of legacy networks to save on energy and downsize their portfolios of central offices. In the United States, however, we expect deployments of homes passed to continue full steam ahead, given a mere 56% penetration of homes passed at the end of 2023. Overall, the transition to fiber is expected to have positive implications for operators, with reduced O&M, more efficient network topology and better customer experience.

Fibre To The Home penetration by region (2020-2025)

% Homes Connected

5. Data centers become the central engine for growth as the demands of AI, edge and cloud computing increase

Data centers are emerging as the linchpin for the exponential growth of the digital age. This surge is propelled by a convergence of factors, including the steady transition to cloud computing deployments, burgeoning demand for AI, and increasing edge computing requirements in Tier II cities.

The growth of data centers is intricately tied to the rapid adoption of cloud computing and AI technologies. As businesses and consumers increasingly demand real-time data processing and low-latency responses, the need for decentralized computing power has become paramount. Consequently, data centers are strategically positioning themselves closer to clients, reducing latency and ensuring seamless connectivity. Simultaneously, the infusion of AI into various facets of technology has created an insatiable appetite for computing resources, for both training and inference, driving the growth of data center capacity. The global data center market is expected to grow at a compounded annual rate of 11%, with a significant portion attributed to the surge in edge and AI-related deployments. Tier II cities are experiencing remarkable growth in planned facilities, aiming to exceed 2.5x their current capacity, reflecting a clear trend towards decentralization that is reshaping the geographical distribution of these critical facilities. As the supply of AI chipsets becomes less constrained, the demand for data center capacity will only intensify. Data centers will play a crucial role in shaping a connected and intelligent future.

FTTH High performance compute power dedicated to AI

(exaFLOPs1 of AI workloads)

6. AI surge will reshape and optimize both front-end and back-end operations

The adoption of artificial intelligence stands out as a pivotal trend reshaping the industry’s trajectory. Telcos worldwide are increasingly recognizing the transformative potential of AI, with a growing emphasis on understanding and incorporating this technology into their operations, both at the front end (customer touch points) and back end (internal operations, SG&A).

Despite the collective acknowledgment of AI’s potential, there are substantial variations among telcos in terms of their focus, investments and maturity in AI adoption. Some telecom companies are at the forefront, leveraging AI for network optimization, predictive maintenance and customer experience enhancement, while others are in the early stages of exploration. This diversity underscores the complex and dynamic nature of the telecom industry as it grapples with the integration of AI technologies.

In the process of transitioning into AI-driven organizations, there are three essential priorities to consider. First, it’s crucial to update and refine the way your organization operates and makes decisions to align seamlessly with AI capabilities. This involves adapting processes and decision-making structures to be more AI-friendly. Second, investing in training and upskilling your workforce in AI-related skills is imperative. This includes providing training opportunities for existing employees and actively seeking out new talent with specialized AI expertise. Finally, it is critical to ensure that your data architecture is up to par with the demands of AI. A robust data infrastructure that can efficiently manage and analyze data at scale is essential for informed decision-making and deriving valuable insights.

Based on the investments and programs we have firsthand experience with, we project that by the end of 2024, a substantial number of telcos will reach a critical juncture in their AI journey, and we expect the telco AI market size will grow 20%-30% annually in the foreseeable future (3-5 years). We are certain that AI-driven technologies will contribute significantly to operational efficiency and effectiveness (a minimum of 10%-12% productivity improvement), leading to a marked reduction in operational and investment costs as well as a noticeable improvement in service quality.

We anticipate 2024 to be a watershed year for the telecom industry, marking the culmination of efforts in defining and implementing comprehensive AI strategies. Telcos are poised to transition from experimental phases to widespread deployment, harnessing AI’s power to enhance network performance, automate processes and elevate customer experiences. The convergence of 5G and AI will unlock unprecedented opportunities for growth and cost efficiency, paving the way for a more connected and intelligent future. As telcos continue to invest in AI research and development, collaboration and skill development, the industry is primed for a transformative journey into the era of intelligent telecommunications.