A Kingdom in Transition: Demographic Shifts in Saudi Arabia

A Kingdom in Transition: Demographic Shifts in Saudi Arabia

Saudi Arabia’s 2022 Census and its implications.

A Demographic Evolution

The demographic shifts visible in the Kingdom of Saudi Arabia’s 2022 census place the Kingdom at a crossroads. Other countries at a similar inflection point, e.g., Singapore and South Korea, have made important choices to carry them forward. The demographic trends in the Kingdom hold important implications for its social development landscape and surface important policy decisions that the Kingdom will need to make to take advantage of the energy of its people and the opportunities presented by its human assets.

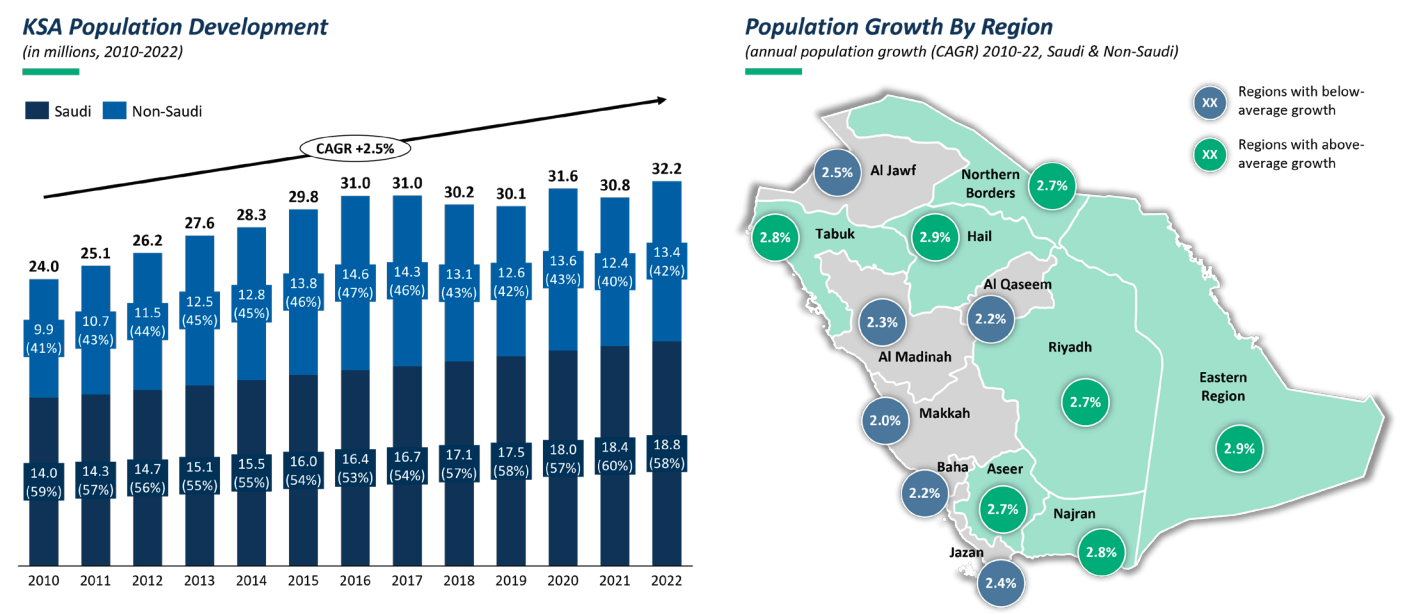

In little more than a decade, the Saudi population has surged from 24.0 million to 32.2 million, marking a remarkable 34% growth from 2010 to 2022 (see Figure 1).

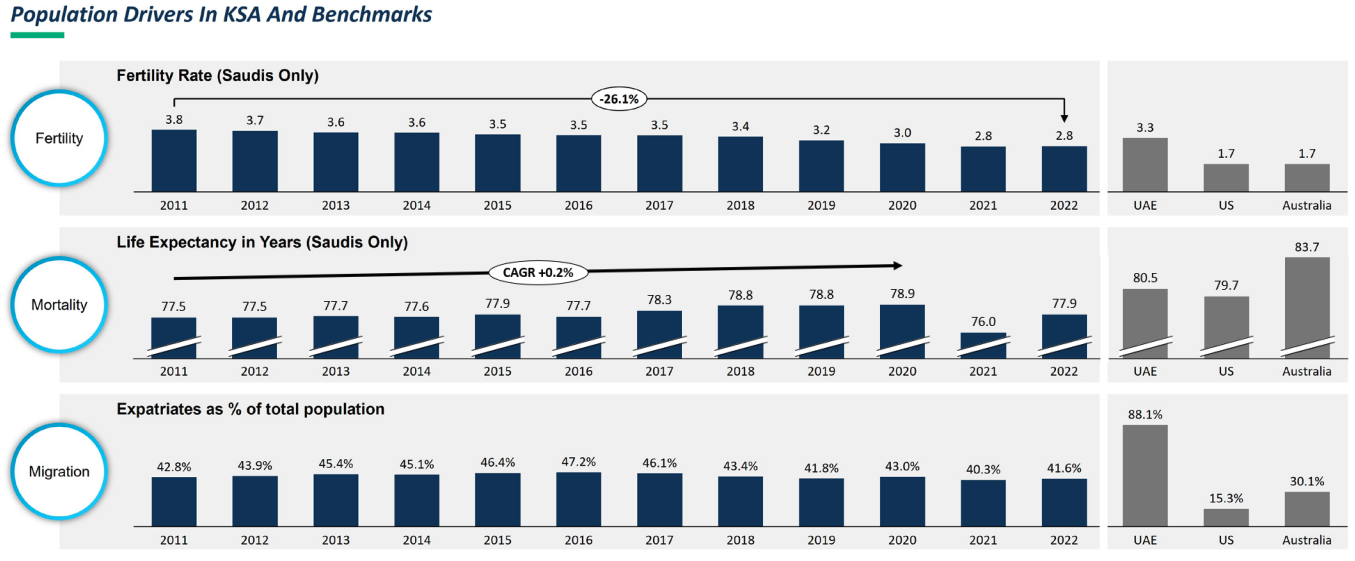

Three pivotal factors stand out in the census data: declining fertility rates, improved life expectancy, and migration dynamics (see Figure 2). Saudis’ fertility rates have dipped from 3.8 to 2.8 children per woman since 2011 but are still significantly above countries like the United States and Australia, where fertility rates stand at 1.7. During the same period, life expectancy among Saudis improved, although it is still below that of other advanced economies. Finally, migration has surged, as the expatriate population has increased to 13.4 million from 9.9 million: a significant, albeit slightly diminished share of the demographic pie¹ .

FIGURE 1: POPULATION DEVELOPMENT IN THE KINGDOM OF SAUDI ARABIA (KSA)

Looked at more closely, two trends hold special importance for the Kingdom’s future: an increasing urbanization and an ongoing demographic transition.

The Urban Pull

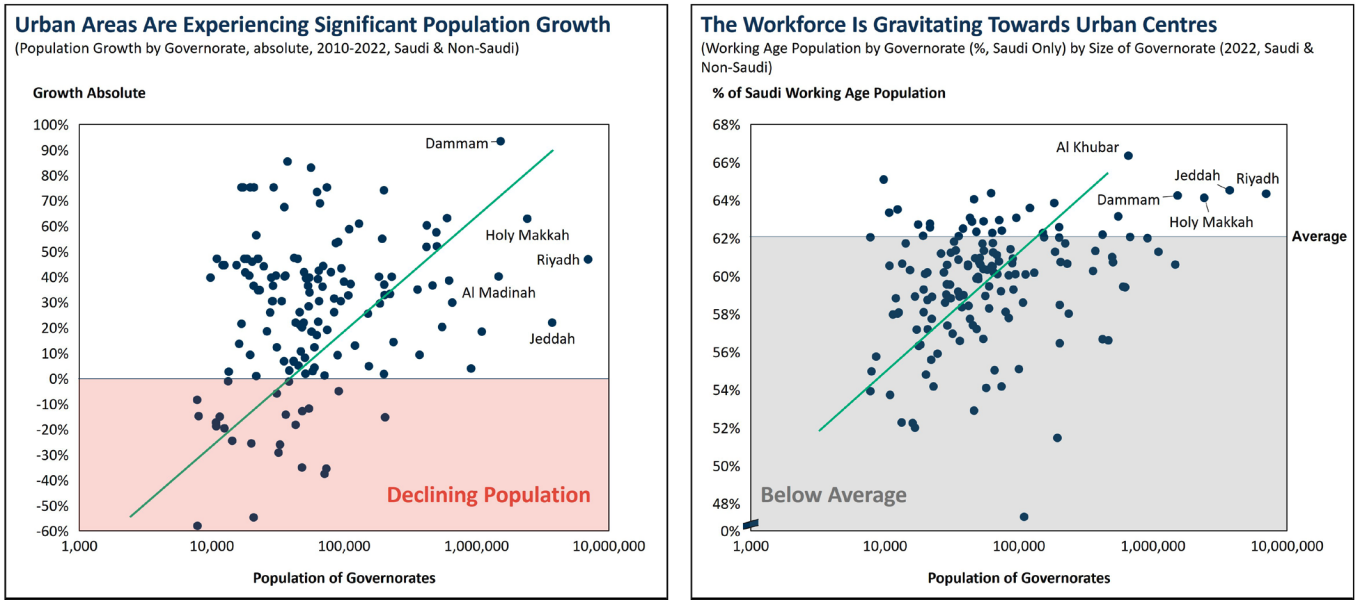

Saudi Arabia’s urban centers are drawing in residents at an unprecedented rate, as the Kingdom is investing in infrastructure, housing and job opportunities in cities. In fact, the country’s five major urban areas have registered a 45% population uptick, outstripping the national average of 34%. This urban drift, which is especially pronounced among the youth, may point to an underlying shift in societal structures and preferences (see Figure 3)

FIGURE 2: DRIVERS OF POPULATION GROWTH

Expectancy: KSA: Saudi Census 2022; UAE, US & Australia: WorldOMeter (2023 data); Migration: KSA: Saudi Census 2021; UAE, US & Australia: William Russell – The

World Expat Index (2022 data); FTI Consulting Analysis

FIGURE 3: URBANIZATION IN SAUDI ARABIA

Census 2010; Saudi Census 2022; FTI Consulting Analysis

The Demographic Transition

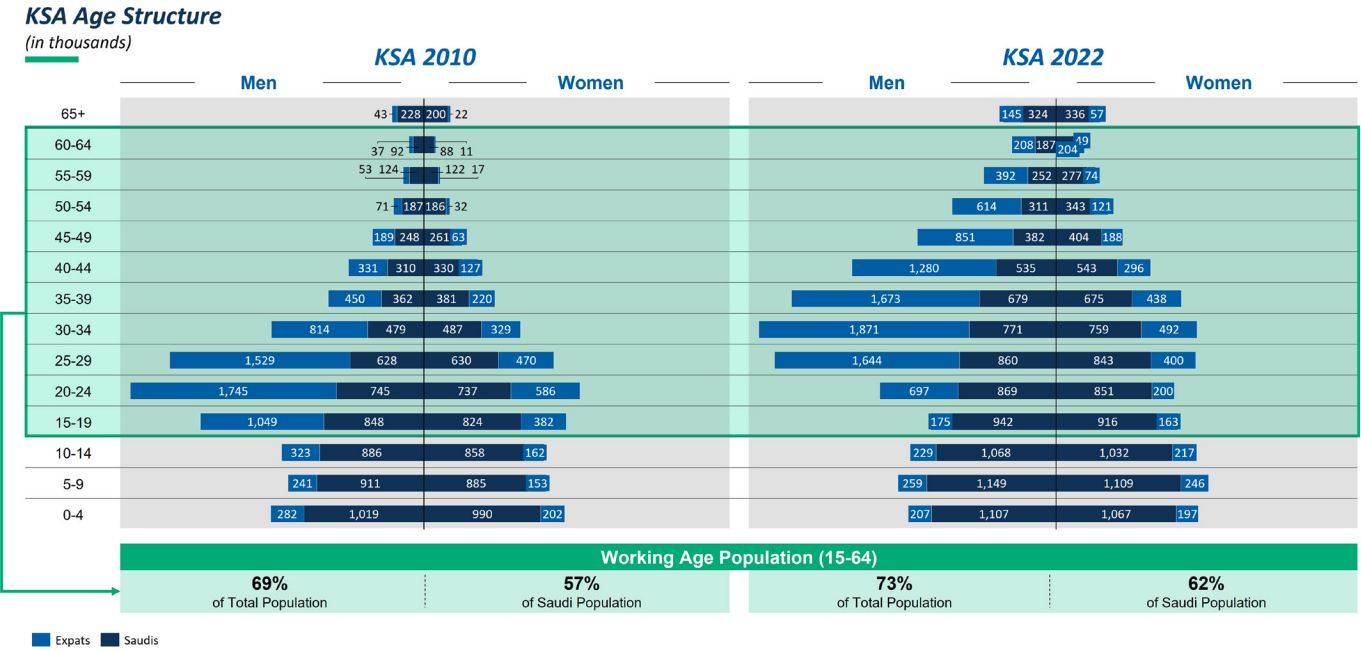

A second key trend that is apparent from the census data, and which we have also seen in our experience working in the region, is a demographic transition. This transition becomes clear when looking at the shift in age structure between 2010 and 2022 (see Figure 4): as the population is aging, the share of elderly people is increasing (from 3.0% to 3.5% for Saudis) and the share of young people (below 15) is decreasing (from 39.5% to 34.8% for Saudis). Compared with other advanced economies, though, young people are still a major portion of the population in the Kingdom: the median age is just 22 years for Saudis (up from 19 years in 2010) vs. ~38 Years in Australia and the United States² .

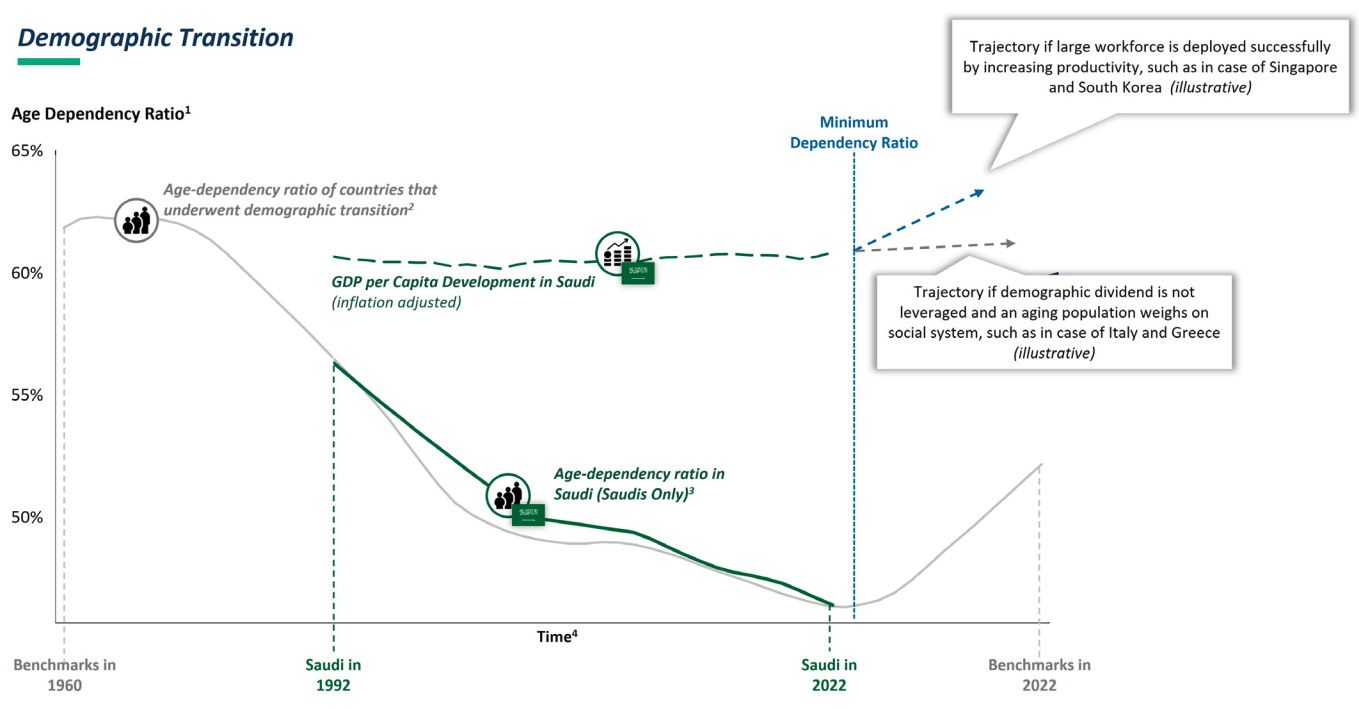

All of these changes signal a great opportunity for the Kingdom: having a greater proportion of the population of working age can lead to a temporary boost in the labor supply, which translates into an increase in economic activity and output if the available workforce is effectively deployed (in other words, if high labor force participation and productivity levels are achieved).

Our analysis shows that Saudi Arabia is currently at the end of a window of opportunity (see Figure 5). Effective policies and interventions during this period can lead to significant economic growth and wealth creation and accumulation for future generations.

However, the opportunity to take advantage of this demographic dividend is time-sensitive. As the nation progresses, the demographic/economic trends might cause the pendulum to swing back, with dependency ratios rising again, exerting pressure on systems like pensions.

FIGURE 4: KSA’S AGE PYRAMID

FIGURE 5: DEMOGRAPHIC DIVIDEND

Charting the Way Forward

To effectively address the challenges and opportunities posed by urbanization and the demographic shifts that we have described, our experience suggests that the Kingdom needs to work toward three key policy outcomes:

Maximize Urban Growth Advantages While Bridging the Urban-Rural Divide: Allocate resources to urban infrastructure (including public transport, housing and digital networks) and guarantee equal access to high-quality social services across urban and rural landscapes.

Leverage the Demographic Transition: Channel investments into education and skill development to equip the workforce for roles that drive productivity.

Anticipate the Changing Age Dynamics: Build a resilient pension system and enhance healthcare and social care services to cater to an older demographic.

Achieving these outcomes will require a multisectoral approach across areas such as healthcare, education, labor, social assistance and culture, as well as broader urban and regional planning.

Of course, the above is only one piece of the more comprehensive national community development planning that the Kingdom and other countries in the region should undertake, and which would typically address all population segments across all wellbeing and development enablers.

Footnotes

Sources: Fertility: KSA: Saudi Census 2022; Australia & US: World Bank (2021 data); UAE: Dubai Statistics Center (2019 data, for Dubai only; excluding expats); Life Expectancy: KSA: Saudi Census 2022; UAE, US & Australia: WorldOMeter (2023 data); Migration: KSA: Saudi Census 2021; UAE, US & Australia: William Russell – The World Expat Index (2022 data); FTI Consulting Analysis

Sources: Saudi Census 2022; GASTAT Statistical Database; The World Factbook